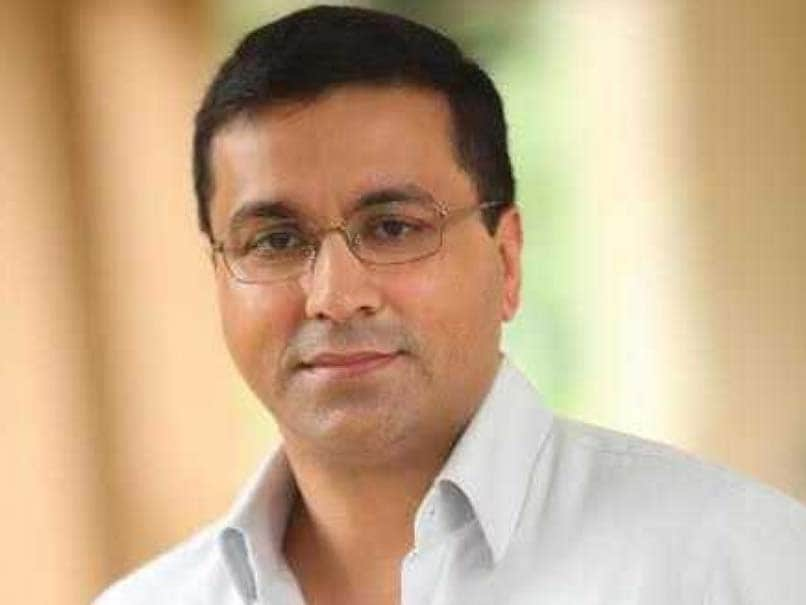

We Are Expecting Historic Numbers From IPL Media Rights: Rahul Johri

The bidding for various media rights auction of the cash-rich league for a five-year period from 2018-2022 will take place in Mumbai on Monday.

- Press Trust of India

- Updated: September 02, 2017 09:25 pm IST

Highlights

-

Media rights auction will take place on Monday

-

Rights have been segregated in two categories --broadcast and digital

-

Monday's auction could produce historic numbers, says Johri

The BCCI Chief Executive Officer (CEO) Rahul Johri says the revenue generation from the upcoming IPL media rights auction could be "historic", considering the huge interest shown by various stakeholders. "Monday's auction could produce historic numbers. While I am not in a position to predict numbers, our primary focus is to deliver a transparent and robust bidding process for each and every stakeholder," Johri told PTI during an interaction ahead of the auction.

"We are extremely grateful to the Honourable Supreme Court and the Committee of Administrators (COA) for having faith in our existing system," he added.

The bidding for various media rights auction of the cash-rich league for a five-year period from 2018-2022 will take place in Mumbai on Monday.

The rights have been segregated in two categories --broadcast and digital (internet and mobile) rights.

The rights on offer are Indian sub-continental TV rights, which is the most coveted along with emerging Indian sub-continent digital rights.

There is also rest of the world media rights on offer which includes key international markets like the Middle East, Africa, Europe, USA, Australia and New Zealand.

There are predictions that BCCI could be richer by more than Rs 20,000 crore through their earnings from the rights.

In 2008, Sony Pictures Network won the IPL media rights for a period of 10 years with a bid of Rs 8200 crore. The global digital rights of IPL for a period of three years was awarded to Novi Digital in 2015 for 302.2 crore.

"The IPL is one of the biggest cricketing property globally. That the best companies in the global market have shown interest is a testimony to the value that it brings in for the investors," said Johri.

The digital rights market for Indian sub-continent could see a two-way battle between Reliance Jio Digital Services, and Airtel.

Johri agreed that digital rights could throw up interesting numbers.

"You have to understand digital market is growing very rapidly. The increase in bandwidth and connectivity for all the major digital players have also helped. The IPL is a catalyst for the growth of their business," said the CEO of India's richest sporting body.

There could be a possibility that some of the major players may get into a consortium (association of companies) to place bid for the global rights.

Asked if any major Indian company with interest in broadcast gets into a tie-up with an international player vying for digital rights for the rest of the world, Johri said that the possibility cannot be ruled out.

"Any combination as far as consortium is concerned is possible. We have to provide the best service to the stakeholders. A particular company may have a strong presence in one of the markets but may like to have an association with a company that has strong foothold in another market. If they come together and become the highest bidder, they are welcome," Johri said.

Johri also explained the reason why the period of rights has been reduced from 10 years to five years.

"A preiod of 10 years was too long a period from a buyer's perspective as well as seller's perspective. In an ever changing world, a decade is a very long period which restricts the property (IPL) from growing.

"Now we have digital rights for five years. Currently, digital feed (live streaming) is a delayed but we don't know how scenario will change after five years," he stated.

The notable companies that have picked up tender document are Star India, Amazon Seller Services, Followon Interactive Media, Taj TV India, Sony Pictures Networks, Times Internet, Supersport International, Reliance Jio Digital, Gulf DTH FZ LLC, GroupM Media, beIN, Econet Media, SKY UK, ESPN Digital Media, BTG Legal Services, BT PLC, Twitter, Facebook Inc, BamTech, YuppTV, Discovery, Oath (Yahoo), Airtel, DAZN Perform Group.